26th JAMCO Online International Symposium

December 2017 - June 2018

Internet Utilization of TV-Stations:Situations and Issues Faced by Individual Countries.

Trends and Shifts in German Broadcasting in the Video Streaming Era

In Germany, as in other industrialized countries, the convergence of broadcasting and the internet began in the late 1990s, developed gradually in the 2000s, and has become more and more extensive and pronounced since 2010 owing to a number of phenomena, including the spread of broadband, improvements in video streaming technologies, the spread of new information devices like the smartphone, and the emergence of new platforms, such as social networking services (SNS).

This paper will initially provide an overview of the changes in media use in Germany in Chapter I. Next in Chapter II, we shall discuss the services provided by Germany’s public and commercial broadcasters, as well as the legal frameworks relating to the video streaming provided by the former and the business models of the latter amid this changing information and communications environment. Chapter III in the final part of this paper will feature the broadcast contribution fees, which provide funding for public broadcasts, an arrangement that responded promptly to the convergence of broadcasting and the internet.

Chapter I. Changes in Media Use

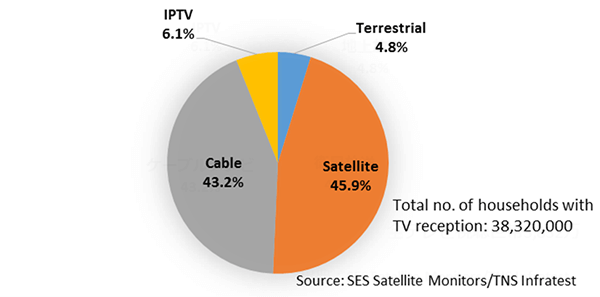

Before we discuss the convergence of broadcasting and the internet in Germany, let us ascertain the use environment for television broadcasts and the internet. Figure 1 shows how television was transmitted to households as of December 31, 2016. Many households in Germany were traditionally cable subscribers, but in 2011 they were surpassed by the number of households relying primarily on satellite, with this gap gradually widening since then 1. And in 2016, reliance on internet-protocol television (IPTV) services from telecom companies on closed networks surpassed that for terrestrial broadcasts.

Figure1. Television reception methods in Germany (as of Dec.31, 2016)

The survey for Figure 1 did not include the use of so-called “over-the-top” (OTT) services, the live streaming and video-on-demand available on the open internet, that bypass the telecom providers; though as we shall see later, they are likely to have a certain share.

In Germany, there have been separate arrangements in broadcasting for the hardware (transmission) and software (program production), with the telecom providers basically supposed to be responsible for the running of the transmission networks as far back as the 1960s 2. We could say that this, along with encouragement from the market principle, has had the broadcasters constantly going after audiences with new means of transmission, as they have not faced systematic restrictions when ensuing technical advances have made a new methods available. Cable and satellite thus became widespread means of television reception in the 1980s and 1990s, with the addition of IPTV and the internet after 2000, with them establishing themselves as the fourth and fifth means of transmission. Today the major television channels are the same, whatever means is used to watch them.

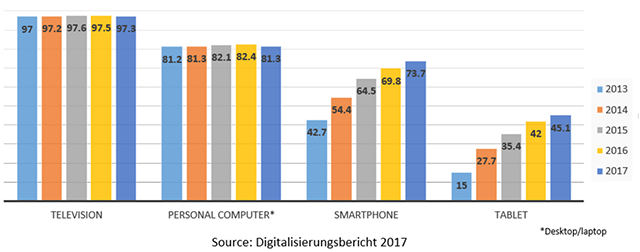

Figure 2 shows the shifts in access to different types of receivers for videos among Germans over the age of 14. Access to TV sets has remained constantly around 100%. The sharp rise in smartphones is particularly striking, with them approaching the same level as personal computers.

Figure2. Shifts in access to receivers

As of December 31, 2016, 79% of German households were connected to fixed-line broadband, while 63.1 million people were using mobile broadband, of whom 39 million were using long-term evolution (LTE) 3.

In addition, 46.8% of households owned a smart television or else a TV set connected to the internet via a set-top box (e.g. Amazon Fire, Apple TV, etc.) or the likes of a personal computer 4. In other words, just under half of all households have an environment where they can watch online videos on their TV sets.

Next, let us look at actual media use in such an information and communications environment.

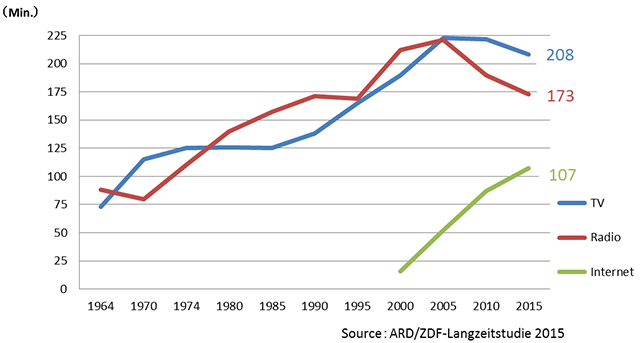

Figure 3 shows the shifts in the average amount of time per day Germans over the age of 14 spend on different types of media, based on data from the long-term surveys concerning media use that the public broadcasters ARD and ZDF have been routinely carrying out since 1964. The amount of time spent on the internet has grown sharply, while on other hand, the amount of time spent on TV has not fallen all that much 5. In 2015, an average of 107 minutes per day were spent on the internet. The figure includes 3 minutes spent watching TV programs via the internet, and 4 minutes spent watching videos that had not been produced by TV stations.

Figure3. Shifts in average time spent on different media

(for all ages over 14)

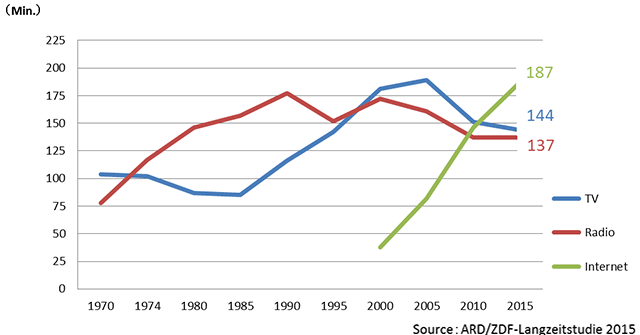

Figure 4 shows the amount of time spent on different media by people in the 14-29 year age group, taken from the data used for Figure 3. The amount of time spent on television and on the internet were mostly the same in 2010, but the positions had been considerably reversed by 2015. That year, people in this age group spent an average of 187 minutes per day on the internet. The figure includes 6 minutes spent on watching online TV, and 8 minutes on videos not relating to television.

Figure4. Shifts in average time spent on different media

(by people in the 14-29 age group)

A different survey in 2017 found 9% of teenagers in the 14-19 age group did not use a TV set at all. The figure was 15% for people in the 20-29 year age group, 7% in the 30-39 year age group, 3% in the 40-49 year age group, 2% in the 50-59 year age group, 1% in the 60-69 year age group, and 2% for people over the age of seventy 6.

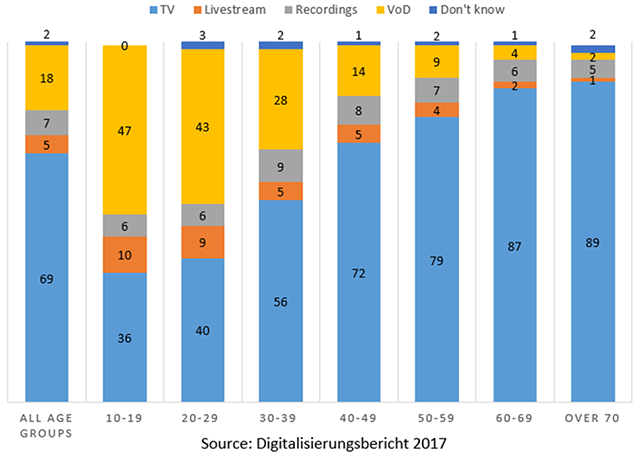

Next, let us compare the data for time spent on linear viewing and video-on-demand. Figure 5 shows the data based on the replies people made to the question of how much time in a week they spend on four different types of viewing: TV broadcasts, online livestreams, recorded programs, and online video-on-demand. The vast majority of people over the age of thirty spend their time watching television in a linear manner, while teenagers and young people in the 20-29 year age group spend more time watching video-on-demand, which can be accessed when desired outside of any particular time.

Figure5. Average time per week spent on linear viewing and video-on-demand

(by age group)

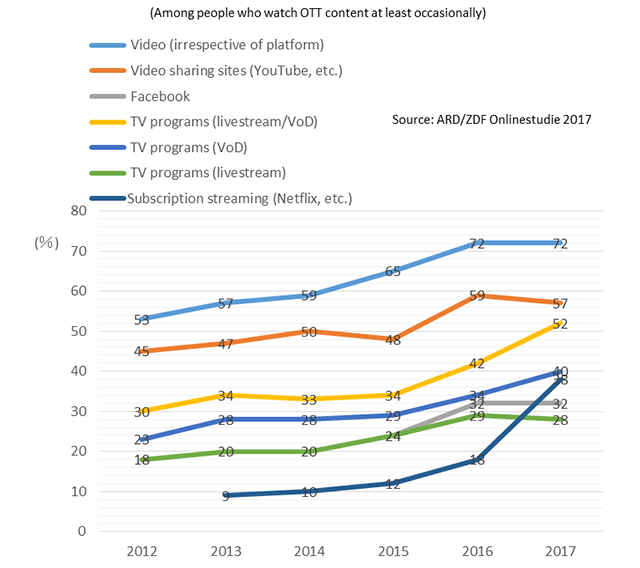

Next, let us take a closer look at the ways people watch videos online (hereinafter referred to as OTT viewing). Figure 6 provides data on OTT viewing according to platform. The target group was Germans over the age of 14 who watch OTT content at least occasionally. Video sharing sites such as YouTube are the most popular way of viewing OTT content, followed by the social networking service Facebook; but there was little or no change for both in 2016 and 2017. On the other hand, there has been a marked increase in OTT viewing of TV programs (both livestream and video-on-demand) and for services such as Netflix and Amazon Prime, which charge set fees for streamed content.

Figure_6. OTT viewing (by platform)

The same survey also provided some interesting data on OTT viewing of television programs. It asked people whether they watched TV programs in an OTT format at least once a week, irrespective of whether it was livestream or video-on-demand. The figure for all age groups was 22%. It was 22% for people in the 30-49 age group, 16% for people in the 50-69 age group, and 9% for people over seventy. It was quite pronounced, though, at 43% for teenagers and young adults in the 14-29 age group 7.

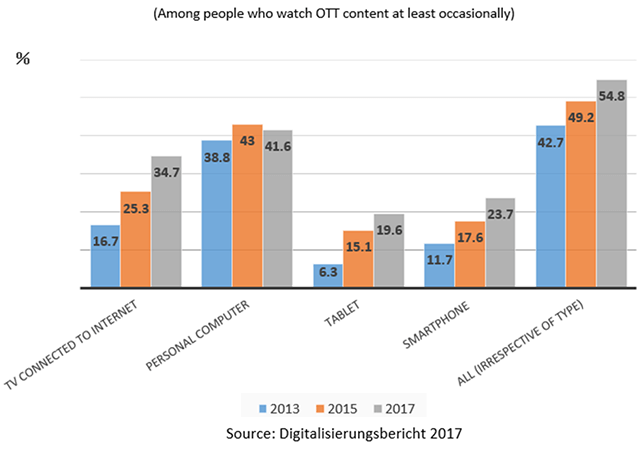

Figure 7 provides data on the type of receivers people use for OTT viewing. There has been a big increase in OTT viewing via mobile devices, such as smartphones and tablets. Viewing via fixed terminals, such as personal computers, has declined, but there has been major increase in viewing via TV sets connected to the internet.

Figure7. OTT viewing (by type of receiver)

As we have seen, people in Germany, as elsewhere, use a variety of receivers to view videos, including TV programs. With TV programs also, we can say that a style of “extended viewing”, whereby people watch TV when and where they want, is spreading and complimenting existing viewing behavior. This tendency is likely to go even further from now on. Although a comparatively large proportion of teenagers and young adults in the 10-29 age group do not use a TV set at all, and are spending less time watching television, we should also note that a conspicuously large number of them are watching TV programs regularly online in comparison to people in other age groups.

So what kinds of services are providers offering for this kind of behavior in media use? We will look at this in the next chapter.

Chapter II. The Current Situation for Services Converging Broadcasts and the Internet

II-1. Overall Situation

The Television Marketplace

The public and commercial broadcasts have a more or less equal share of viewers and revenue in Germany’s television marketplace.

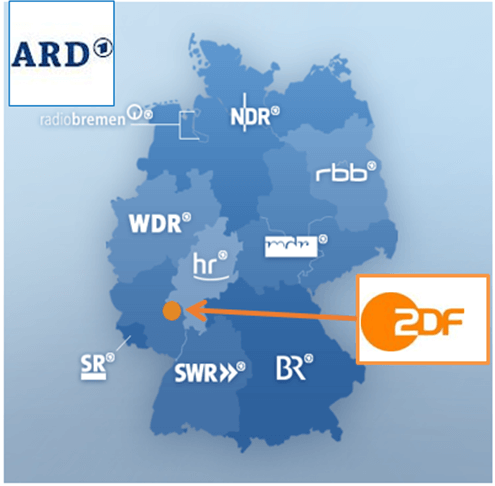

Public television broadcasting is comprised of nine regional broadcasters (which make up the ARD or Consortium of public broadcasters in Germany) and ZDF (Second German Television). (See Figure 8.)

ARD and ZDF together have 20 television channels, four of which are jointly operated. Broadcast contribution fees levied from all households and business premises are the major source of their funding, comprising about 86% of the total. There are also television and radio advertising and sponsorships, which account for about 6% of revenues.

Figure8. Germany’s public broadcasters

The market for commercial broadcasts, relying chiefly on advertising, is dominated by two major groups, ProSiebenSat.1 Media, and RTL (Mediengruppe RTL Deutschland).

The former was created from the merger in 2000 of the four commercial TV stations in the Kirch Group headed by the late German media magnate Leo Kirch. It currently operates in German-speaking countries such as Austria and Switzerland, and has 10 television channels in Germany.

Mediengruppe RTL Deutschland is part of the European-wide RTL Group headquartered in Luxembourg, which in turn is controlled by the German-based media conglomerate Bertelsmann. Mediengruppe RTL Deutschland currently has 12 television channels in Germany 8.

Commercial broadcasts were allowed in Germany after satellite-based cable TV became technically feasible in the 1980s. So from the outset, commercial television has mostly been nationwide relying on satellite and cable. The nine regional broadcasters in ARD have their regionally oriented channels, but they can also be viewed nationwide.

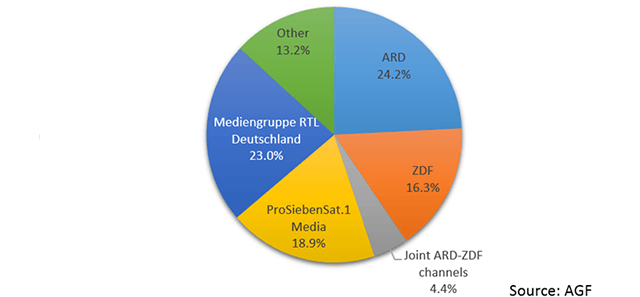

Figure 9 shows the share of TV viewers in 2016. The public broadcasters had 44.9% of the total, while the two giant commercial broadcasters had a 41.9% share.

Figure9. Share of TV viewers by group (2016)

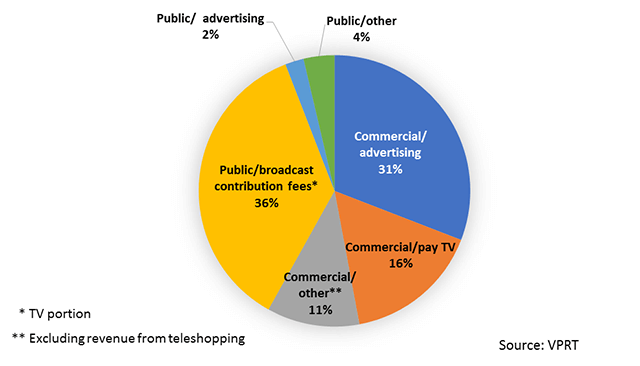

Figure 10 shows the revenue for television operations in Germany in 2016. Public broadcasters had 42% of the total, while the commercial broadcasters accounted for the remaining 58% (the figures excluded revenue from teleshopping).

Figure10. Revenue for TV operations (2016)

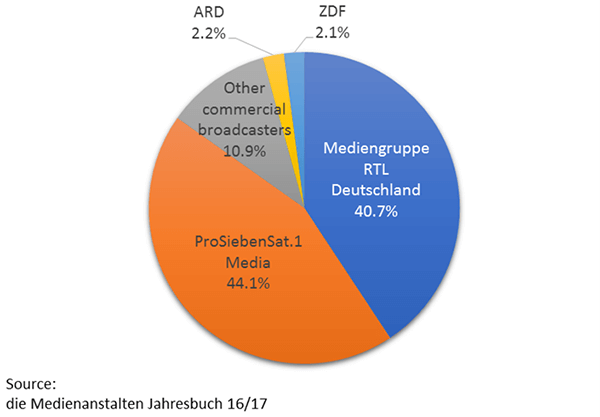

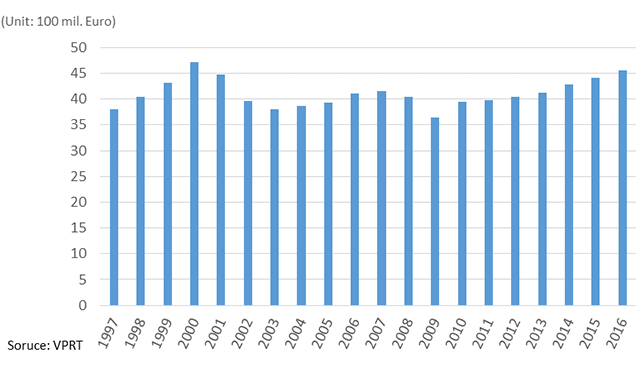

Figure 11 shows where television advertising revenue went in Germany in 2016. The two giant commercial groups have a duopoly. Figure 12 shows the trends in TV advertising revenue in Germany. It has been particularly steady since 2009.

Figure11. Television advertising revenue (2016)

Figure12. Shifts in advertising revenue

OTT Services from Broadcasters

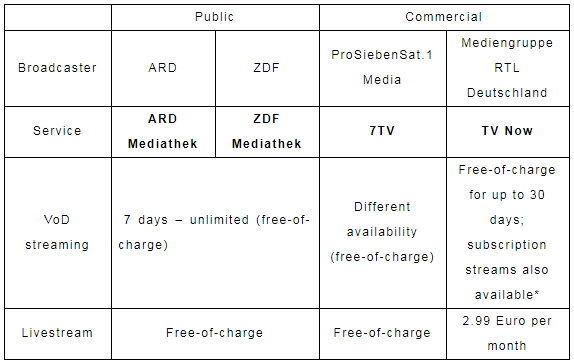

All of Germany’s public and commercial broadcasters launched catch-up video-on-demand streaming in earnest over the period from 2006 to 2008, and have been offering constant livestreaming from 2013. Table 1 lists the current OTT streaming from broadcasters. The video-on-demand streaming from all broadcasters tends to be seven-day catch-up services, with few programs being offered beyond that period. Elsewhere, the youth-oriented funk has been offering a streaming service since October 2016, which shall be discussed later.

Table 1. OTT services from broadcasters

*App charges a fee of 2.99 Euro per month

The broadcasters are pursuing multi-screen strategies in accordance with the viewing behavior of the younger generations, offering OTT services in the form of smartphone and smart TV apps. They also let viewers access, search and watch the above services from their TV sets via HbbTV, the European standard for hybridizing television and broadband. It can be done on the same screen during real-time TV viewing. (HbbTV shall be discussed in II-3.)

Livestreaming Platforms (IPTV, OTT)

In the previous chapter, IPTV and the internet were described as establishing themselves as the fourth and fifth means of transmission. Let us look at the livestreaming platforms for convergent services on the transmission side.

IPTV services began in Germany in 2006, and over the next decade spread to the extent where they surpassed the amount of television watched via terrestrial broadcasting.

They include Entertain TV from Deutsche Telekom (the nation’s largest telecom carrier) and Vodafone TV, as well as waipu.tv, a new type of service launched in October 2016 by the newcomer Exaring, that enables people to access TV on their smartphones, Chromecast or other small devices without the need for any set-top box.

Zattoo is another leading livestreaming OTT platform for public and commercial telecasts that has been available from 2007, as is Magine, which commenced in 2014. The providers have not published any figures about the amount of people using their services, but we can surmise that they are also being used to a considerable extent from Figure 6, which shows the degree to which people watch livestreams of television via OTT.

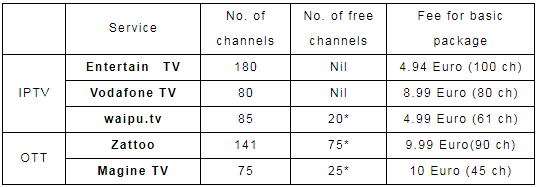

Table 2 lists the livestream platforms. The free channels tend to be public. ProSiebenSat.1 Media and Mediengruppe RTL Deutschland only offer their services on a subscription basis.

Table 2. Livestreaming platforms (IPTV, OTT)

*ProSiebenSat.1 Media and Mediengruppe RTL Deutschland only offer pay channels

Subscription Video-on-Demand (SVoD) Providers

Figure 6 also showed a surge in the number of people using subscription video-on-demand (SVoD) providers, which are in competition against the video-on-demand services from broadcasters. Amazon’s Amazon Prime and Netflix (which has been available in Germany since September 2014) are among the leading providers, as is Maxdome (a subsidiary of ProSiebenSat.1 Media), which was a pioneer in the nation’s SVoD. Although none of them has published any subscriber figures, a sampling study in 2017 found 22% of people were using Amazon Prime at least occasionally. The figures for Netflix and Maxdome were 12% and 6% respectively 9.

II-2. Legal Arrangements for the Online Services provided by Public Broadcasters

This section will discuss the legal arrangements concerning the online services provided by public broadcasters. Funding arrangements will be dealt with in Chapter III.

The Dawn of Digital Services

ARD and ZDF set up websites in 1996, but it was not until 1999 that there was any legal regulation of their online services, which stipulated they should chiefly relate to their programs. In 2003, the wording was changed, stipulating that the content was to be ancillary and relating to programs, limiting it in the sense of letting people delve more into programs.

Evolution of Video-on-Demand

As digital services expanded in the 2000s, Germany’s newspapers and commercial broadcasters lodged a complaint with the European Commission, which is responsible for competition-related issues within the European Union, alleging that the online services from the public broadcasters were skewing fair competition in the marketplace to the detriment of the private sector. In December 2008, all sixteen of the state governments carried out large-scale legal revisions in response to the investigation from the European Commission, which urged the German government to make changes in a number of matters, viz. defining the remit of the public broadcasters, supervisory arrangements, and separate accounting for the public services and commercial activities undertaken by the public broadcasters. This was happening just as video streaming was starting in earnest, so legal arrangements were also made for the online services provided by the public broadcasters 10.

The amendments in December 2008 deemed online services to form part of the basic remit of public broadcasts to function as a means and factor for individuals and the public freely to form their own opinions, and to provide programs that will inform, educate, serve and entertain, and that will also contribute particularly to culture. Furthermore, they added some basic definitions concerning the singular objectives of such services with respect to the provision of opportunities for all groups to participate in the information society and help for people to orient themselves in an increasingly complex society. They are also supposed to help in the media literacy of the public.

Rules were established for video-on-demand. It is restricted to broadcast programs, which are usually made available for up to seven days from when they were aired. The in-house supervisory bodies for public broadcasts must review any proposals to make programs available beyond that period. The review is carried out in three stages and is consequently referred to as Drei-Stufen-Test (the three-step test). It looks at whether the proposed services (1) meet the democratic, social and cultural needs of society; (2) would make a positive contribution to the journalistic competition with the private providers; and (3) would be appropriate in terms of costs. Step 2 has outside experts determine the ramifications for the marketplace and considers the views of other relevant parties.

At this stage, no specific provisions have been provided for livestreams. The re-transmitting of a broadcast simultaneously with the same content was not particularly problematic; it is treated in the same manner as a re-transmission by cable TV or IPTV 11.

funk for the Young: Multi-screen Streaming

In Chapter I, we looked at the changes in the media environment and patterns of media use, which have become particularly pronounced since 2010. People are using a whole range of devices to watch videos, including smartphones, tablets, personal computers, and smart TVs. And when it comes to TV programs, people, particularly in the younger generations, are leaning more and more toward watching them where and when they like.

Around this time, there was talk of reorganizing and merging the thematic television channels produced by ARD and ZDF that had been created to propel Germany’s digital broadcasting services. ARD and ZDF considered a plan under which two out of six thematic channels for the likes of news, entertainment, services, youth culture would be merged into an internet- and radio-linked television channel for teenagers and young adults in their twenties operated jointly by the two broadcasters. The sixteen state governments, which have authority over broadcasting policy, decided in October 2014 to have ARD and ZDF provide an online-only program streaming service for the young in return for them closing down two channels. The decision, announced from the top, as were, came as a surprise to the public broadcasters; the state governments justified it on the grounds of the media use patterns of the young. Legal amendments to have ARD and ZDF provide these streaming services to the young were subsequently passed in October 2015, following hearings and suchlike to ascertain the views of the interested parties.

The amendments retained the abovementioned regulatory framework of 2008, treating the youth-oriented streaming as a special case. First up, in the matter of content and objectives, they specified that the streaming would enable public broadcasting to fulfill its basic remit, among other things, reflecting the interests of young people and helping them to shape their own opinions. It was exempted from the rules in number of ways, including: (1) streaming-only programs unrelated to broadcast programs could be produced; (2) there would no limits on the availability of content; (3) new information technologies and services could be applied wherever necessary (e.g. offering chat services for dialogue with and comments from users); and (4) films and dramas could be purchased for streaming.

ARD and ZDF accordingly launched the youth-oriented funk streaming service in October 2016 after a twelve-month preparatory period. Although funk has its own portal, the idea has been to make it regularly available on social media, such as YouTube, Facebook, Twitter, Instagram, and Snapchat, to achieve greater contact rates with teenagers and young adults in their twenties. In-house production is done by ARD and ZDF, but on the whole, many of the programs are produced by outsiders or in collaboration with popular, young “YouTuber” producers or production companies run by young people. With these distinctive distribution and production arrangements, ARD and ZDF describe funk as a “public content network”. As we shall see later, this expression is probably meant to set funk apart from the “multi-channel networks” (MCN) that commercial broadcasting is keenly getting into. Initially, funk had forty programs; today there are more than sixty, covering a whole range of genres, including reportage, current affairs, science, discussion, drama, animation, music, fashion, and the featuring of computer games.

Preparations are currently underway to revise the law to have the abovementioned lesser restrictions applying to funk extended to the video-on-demand streaming by public broadcasting in general. The state governments and public broadcasters appear to have recognized that the changes in media use are not just restricted to teenagers and young adults in their twenties. In May 2017, the state governments published draft amendments for doing away with the usual seven-day restriction on availability, and which would allow streaming prior to broadcasts, as well as dedicated production for streaming unrelated to broadcasts. The draft amendments are likely to be debated in 2018 following public comment.

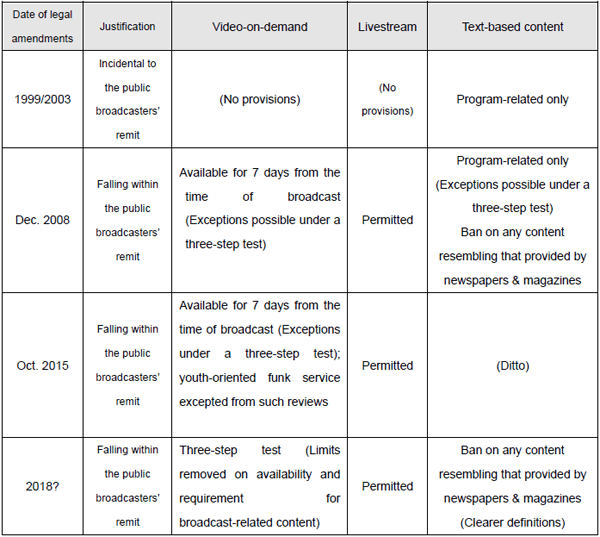

Table 3 shows the legal frameworks that have been provide for the online services of the public broadcasters.

Table 3. Provisions for online services by public broadcasters

II-3. Video Streaming by Commercial Broadcasters

Revenue Structure

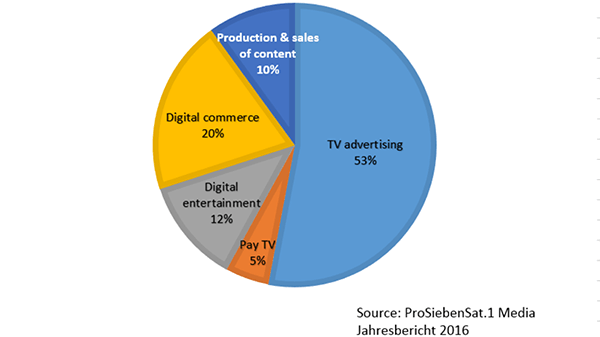

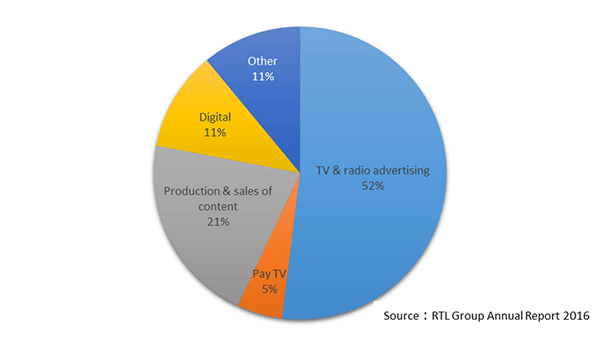

Figures 13 and 14 show the revenue structures for Germany’s two commercial broadcasting giants, ProSiebenSat.1 Media, and the RTL Group (based in Luxembourg).

Figure13. Revenue split for ProSiebenSat.1 Media (2016)

Figure14. Revenue split for the RTL Group (2016)

ProSiebenSat.1 Media puts revenue relating to video streaming, viz. revenue generated by video advertising (in-stream ads), subscription video-on-demand, and multi-channel operations, etc., under the category of digital entertainment. It accounted for 12% of the total in 2016 (compared to 11% in 2015). The RTL Group places this revenue under the digital category. It accounts for a similar proportion of the group’s total revenue; the figure was 11% in 2016 (compared to 8% in 2015).

Television advertising accounted for 53% of all revenue for ProSiebenSat.1 Media (which does not have any radio services), while TV and radio advertising accounted for a similar proportion of the revenues of the RTL Group (52%). The figures for 2015 were 61% and 54% respectively, giving one the impression that ProSiebenSat.1 Media is quickly trying to reduce its dependence on traditional TV advertising.

Video advertising (in-stream ads)

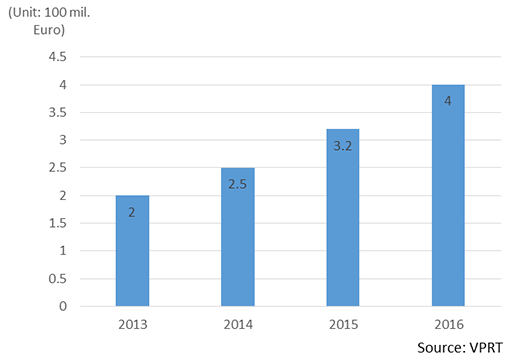

Figure 15 shows the shifts in revenue (total revenue for providers in Germany) generated by the video advertisements, the so-called in-stream ads, which are placed before, after or in the midst of other videos streamed on the internet. These advertisements generated approximately 400 million Euro of revenue in 2016. ProSiebenSat.1 Media, Mediengruppe RTL Deutschland, and the other commercial broadcasters accounted for 40% of the total, with the remaining 60% taken by the likes of YouTube and Facebook 12.

Figure15. Shifts in revenue from in-stream ads

In recent years, both ProSiebenSat.1 Media and the RTL Group have been preparing for the future by buying up companies that provide technology for in-stream ads.

In 2014, the RTL Group acquired a majority stake in SpotX, a firm that streams video ads worldwide, and acquired the firm outright in August 2017. In 2016 it also acquired the German-based advertising technology firm Smartclip, which has been focusing on so-called “addressable TV”, a technology which can insert advertisements on a smart TV via its HbbTV feature to match the traits of a viewer 13. The RTL Group announced in November 2017 that it would combine the two firms by the end of 2018 and create a global platform for streaming advertisements for addressable TV and video-on-demand.

ProSiebenSat.1 Media acquired the German-based video ad streaming firms Virtual Minds and SMARTSTREAM.TV in 2015. In June 2016, it announced that would establish a European-wide platform for streaming video advertisements, known as the European Broadcaster Exchange, in a joint venture with two other foreign commercial TV broadcasters, France’s TF1 Group and Italy’s Mediaset.

At the same time, efforts are being made to attract greater interest from advertisers with more accurate data about the viewing of video streams. In March 2017, AGF Videoforschung (a firm established by Germany’s major broadcasters to research viewer behavior) began providing broadcasters and advertising agencies with uniform viewing data for TV broadcasts and online streams. Data concerning online programs until then had been limited to the number of visits. It was not possible to obtain the type of detailed data that was available for TV, such as viewing by age group, etc. AGF is looking to provide more detailed data with the same indices applied to TV viewing, a research technique developed in collaboration with the U.S.-based Nielsen, because the complicated nature of the analytical methods means it can take up to forty days to release data for each particular month.

Video-on-Demand Streaming

Germany’s two major commercial broadcasters also stream videos that are not broadcast programs. As we have already mentioned, ProSiebenSat.1 Media has been running Germany’s first subscription video streaming service, Maxdome, since 2006. In 2007, it also acquired MyVideo, a German-based video-sharing site rivalling YouTube; but this service was more or less closed down in the autumn of 2015. The RTL Group in July 2017 did away with clipfish, a video-sharing site linked to TV programs that had commenced in 2006, and switched over to watchbox, which relies on advertising to stream films and dramas free-of-charge.

Multi-channel Networks (MCNs)

Both ProsiebenSat.1 Media and the RTL Group have expanded into multi-channel networks (MCNs). MCNs place themselves between YouTube and the so-called “YouTubers”, the producers who stream videos on channels they set up on the former. These networks offer production environments, know-how, and also manage copyright, introduce advertisers, and so on, in return for a share of the advertising revenues. A survey in 2015 found 60.5% of Germany’s major YouTube channels (the top 468) in terms of subscribers and number of views per month were with a multi-channel network 14. ProSiebenSat.1 Media became the owner of Studio 71, the world’s fourth-ranked MCN, in 2015. Since 2013, the RTL Group has acquired the Canadian-based BroadbandTV and the Los Angeles-based StyleHaul, adding the Berlin-based Divimove in 2015.

Impact of the Public Broadcaster-provided Services on the Marketplace

So what impact is the services provided by the public broadcasters having on the market for video streaming? An analysis concerning the youth-oriented funk streaming service provided by ARD and ZDF will serve as an example. The commercial broadcasters expressed concern when the proposal was made for the public broadcasters to provide youth-oriented program streaming in an online only format, arguing that it might skew the marketplace by competing against their own streaming services. ARD subsequently commissioned the market research firm Goldmedia to conduct an analysis of funk’s possible repercussions for the market.

Goldmedia first of all analyzed Germany’s existing market for video streaming. Next, it interviewed 6,000 teenagers and young adults in the 14-29 age group in detail (made a conjoint analysis) concerning their viewing habits if funk were to appear. It found 7.75% of the respondents in this age group were likely to access funk, and that the number of users in this age group for the commercial services would drop by 3%. It also found that funk would take about 4.7% of the revenue in the market for video advertising. Goldmedia accordingly concluded that funk would only have a slight impact on the marketplace 15. On the basis of this analysis, the state governments passed legal revisions in October 2015 to have funk come under the remit of public broadcasting, arguing that funk’s possible negative repercussions for the marketplace would never outweigh its public value 16.

Chapter III. Funding for Public Broadcasting

III-1. Three Pillars of Funding

Finally, let us discuss the funding arrangements for public broadcasting in Germany that were quick to respond to the convergence of broadcasting and the internet.

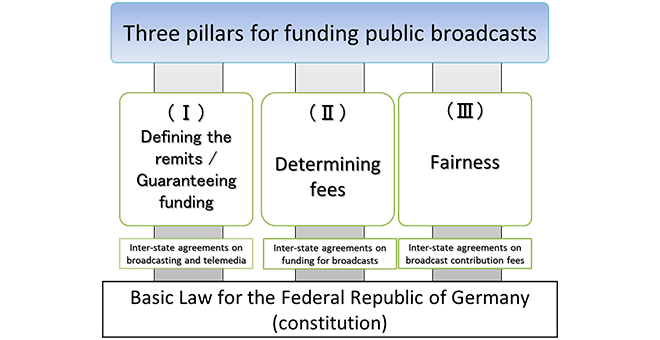

An extensive look at the funding arrangements for public broadcasting in Germany reveals they resemble a triple-pillared structure as in Figure 16. Separate laws have been established concerning (1) the remit of and guarantees for the funding of public broadcasts; (2) the setting of fees; and (3) fairness in payments.

Figure16. Funding arrangements for public broadcasting in Germany

The first pillar defines the remit of public broadcasts and the scope of their services, and specifies that they will be funded by public fees in the form of broadcast contributions (which prior to 2013 were known as license fees). It is also stipulated that the federal and state governments must guarantee the necessary funds for public broadcasts to achieve their remit, and that they must moreover guarantee suitable funding to enable public broadcasts to continue fulfilling their role in the event of any changes in the media environment arising from technical developments.

In section II-2, we saw in detail how the legal revisions of 2008 made online services part of the public broadcasters’ remit. Online live streaming and video-on-demand were added to the existing means of transmission, so that public broadcasts today can be accessed far and wide, irrespective of the type of receiver, be it television, personal computers, smartphones, and so on.

The second pillar establishes the procedures for determining the amount of funding public broadcasting requires and for determining the size of the broadcasting contribution fees that are to be derived thereby. The calculations for the necessary funding are carried out by the 16-member Independent Commission for Assessment of the Financial Requirements of German Public Broadcasts (Komission zur Ermittlung des Finanzbedarfs der Ruddfunkantalten, KEF), which is free of any political pressure, but which can urge greater efficiency in public broadcasts. The KEF assesses the four-year business plans for public broadcasting, determines the revenue it requires, and submits its recommendations every two years to the state governments as to whether there should be any changes to the broadcast contribution fees. The state governments cannot alter the recommended figures without sufficient cause.

The third pillar has established the rules concerning fairness in payments, in accordance with the principle of equality before the law in the nation’s constitution, the Basic Law for the Federal Republic of Germany. This sets out the obligation to pay contributions, the basis for levying them, and penalties for nonpayment, so that there is fairness out of consideration for the technical environments in which public broadcasts might be accessed and from being able to identify the typical users or groups of users that are likely to benefit thereby.

A broadcast contributions scheme levied on all households and business premises irrespective of any receivers in their possession was introduced in 2013. It was a change in arrangements involving the third pillar. Let us look at what was introduced.

III-2. Philosophy behind the Broadcast Contribution Fees Scheme

The numerous problems associated with the license fees introduced in 2007 for new types of receivers, such as personal computers and mobile devices with access to the internet (which were commonly referred to as “computer license fees”), were a direct factor behind the change. Following the introduction, there was a spate of legal suits across Germany arguing that the levying of such fees was unfair if personal computers were not being used to watch broadcast programs. Lower courts came out with differing rulings, and in October 2010, the Federal Administrative Law Court (Bundesverwaltungsgericht) expressed the opinion that while such fees were constitutional, they might conceivably contravene the Basic Law in the future should inequalities arise if the levying of fees on computers and mobile devices became difficult in practice. In fact, a situation was arising which could not be regarded as equitable, in that while the proportion of households registering their receivers was well over 90% on average across each state, the figure for major cities like Berlin, Frankfurt, Munich, and Stuttgart was 76.9-78.5%.

Various proposals were considered to avoid this problem. Professor Paul Kirchhof of the University of Heidelberg, an expert on public law and tax, and former judge of the Federal Constitutional Court, published an opinion advocating a broadcast contributions scheme unrelated to the possession or type of receiver as the best option. Ultimately, this was what was adopted.

Prof. Kirchhof justified the levying of contribution fees even from households without any receivers in the following terms. Given that nearly all homes and business premises in the present day have some form of receiver, such as a TV set, radio, personal computer or mobile device, and given the increasing amount of online services from the public broadcasters, nearly everyone benefits when they wish to access a public broadcast service. The levying of such fees from people without any receiver is justifiable if one considers that they also benefit indirectly from public broadcasts in the overall democratic, free and cultural life of the community 17.

III-3. Developments since the Introduction of the Scheme

Naturally enough, not everyone in Germany was convinced by such arguments. Right after the introduction of the scheme, there were law suits arguing that the obligation to pay by people not possessing any receiver violated the principle of equality before the law, or that that the contributions were effectively a tax, for which the states do not have legislative powers. Since businesses are also obliged to pay fees according to the number of employees and vehicles at each premises, firms with a large number of locations and vehicles also launched law suits saying that large sums they had to pay were unfair and violated the principle of equality. However, in May 2014, the state constitutional courts of Rhineland-Palatinate and Bavaria ruled that the contributions were constitutional in that they did not constitute a tax nor violate constitutional guarantees on equality before the law. In addition, Germany’s highest court on administrative matters, the Federal Administrative Law Court (Bundesverwaltungsgericht), ruled in March 2016 that levying of the contribution fees from households was compatible with equality before the law and constitutional. It made a similar ruling with respect to the levying of fees on the basis of the number of business premises and vehicles in December of that year. All of the court cases to date have found that the contribution fees scheme is constitutional. The Federal Constitutional Court is expected to make a ruling in 2018.

Conclusion

In Germany, as elsewhere, the increased convergence of broadcasting and the internet means a growing pattern of media behavior whereby people are watching videos of their choice – TV programs or otherwise – on a range of different receivers where and when they like.

In the midst of this, the commercial broadcaster, the RTL Group, regards “total video”, of which TV broadcasts form a part, as its core business. It, and its commercial rival, ProSiebenSat.1 Media, also are steadily making preparations to survive in an age of global video streaming by buying up video advertising tech firms, getting into multi-channel networks, and so on.

Funk, which bills itself as a public content network, is a particularly interesting experiment in public broadcasting. Not only does it stream programs for young people independent of broadcasts; it is public broadcasting providing opportunities for program production not dependent on advertising to the same people, the young producers who are right now being drawn by the commercial broadcasters into the advertising business through multi-channel networks (MCNs). In September 2017, a year after the launch of funk, it was announced that it had attracted 256 million views on YouTube and 90 million views on Facebook. Although we have yet to see any solid findings as to how funk is being received by its target audiences of teenagers and young adults in their twenties, it will be interesting to see how it fares over the next five to ten years.

Receivers were taken out in the design of the funding arrangements for public broadcasts, which we can say has provided stability in funding that will be not be at the mercy of short and mid-term changes in the media environment. The background to the relatively smooth adoption of this kind of funding scheme in Germany is perhaps due in large part to its design, which places the remit of broadcasts, the determining of fees, and fairness into three separate domains, so that when times change and it becomes necessary to make modifications in any of them, responses have been made without having to overhaul the whole trinity as it were; and also perhaps in large part to the proper systematic guarantees for the political independence of public broadcasts, an issue which this paper was not able to cover in detail.

It is hoped that this paper can provide pointers when it comes to pondering the present and future of public broadcasting in Japan.

Notes

- 1. In the 1980s the federal government pursued a national project to establish a nationwide cable network (capable of handling about 30 channels) with a view to introducing commercial broadcasts. This made Germany one of the biggest countries in Europe in terms of cable TV. The cable TV provider was privatized in 1999. Satellite broadcasts commenced in 1989 with the government-operated broadcasting satellites in competition with the commercial satellites from the Luxembourg-based SES. The SES services spread rapidly in the 1990s given the low cost of their receivers and the amount of channels they could handle. More than 70% of households still relied on terrestrial broadcasts in 1990, but the amount of such households fell sharply with the spread of cable and satellite.

- 2. The Federal Constitutional Court in 1961 made what is referred to as its first ruling on broadcasting. It affirmed that broadcasts involving the production and sending out of programs came under the jurisdiction of the states, while the operation of the transmission networks for the broadcasts was a federal matter under the category of communications. This type of separation between hardware and software has since become the norm for the European Union countries with the subsequent EU electronic communications directives package of 2002.

- 3. Bundesnetzagentur, Jahresbericht 2016.

- 4. Die Medienanstalten, Digitalisierungsbericht 2017.

- 5. No decline was seen in surveys conducted by AGF Videoforschung (a firm funded by the major German broadcasters to research viewing behavior). The average amount of time per day spent by Germans over the age of 14 watching television was 190 minutes in 2000, 211 minutes in 2005, 223 minutes in 2010, and 223 minutes in 2015-2016.

- 6. Digitalisierungsbericht 2017.

- 7. ARD/ZDF, Onlinestudie 2017.

- 8. Sky Deutschland provides pay television, but this paper shall concern itself with the two major commercial groups that rely on advertising.

- 9. ARD/ZDF, Onlinestudie 2017

- 10. The discussions between the European Commission and the German government are covered by the author in “Towareru Kokyohoso no Ninmu-han-i to Gabanansu: EU no Kyoso-seisaku to Doitsu Kyokyohoso” (Remits and governance of public broadcasters in question: EU policy on competition and public broadcasting in Germany) in Hoso Kenkyu to Chosa (NHK Monthly Report on Broadcast Research), Oct. 2007. (Article in Japanese.)

- 11. Mandatory carrying requirements for IPTV and other new digital platforms were set out in revisions made in December 2007, merging them with the existing requirements for cable TV providers.

- 12. Goldmedia, Wirtschaftliche Lage des Rundfunks in Deutschland 2016/2017 (Dec. 2017).

- 13. Hybrid Broadcast Broadband TV (HbbTV) is a standard for services that bring together broadcasting and the internet. Public broadcasters in Germany and France played a key role in its development. In 2010, it was adopted as a European standard. Commercial broadcasters are also keenly involved in HbbTV services using them in the past few years to provide advertisements in new formats. Viewers, for example, can press a particular button on their TV remote control unit when a spot ad appears to call up a website providing more details about the advertised item. The newer version, HbbTV 2.0, enables addressable advertisements (which can be varied according to the viewer) to be sent via the internet during a linear TV broadcast. The following website from Germany’s Institute for Broadcasting Technology (Institut für Rundfunk, IRT) provides examples of HbbTV 2.0-based addressable ads: http://tv-html.irt.de/demos/IRT_HbbTV_SpotReplacement_Demo.mp4 The RTL Group began airing and streaming addressable ads on its RTLplus channel on August 23, 2017.

- 14. Goldmedia, Gutachten zu den marktlichen Auswirkungen. Junges Angebot von ARD und ZDF, Sept. 2015

- 15. Ibid.

- 16. Staatskanzlei Sachsen-Anhalt、Offenes Konsultationsverfahren zum “Jugendangebot von ARD und ZDF”, Sept. 16, 2015.

- 17. See the author’s article, “Hajimatta Doitsu no Shinjushinryo-seido: Zensetai-choshu no ‘Hoso Futankin’ Donyu made no Kei-I to Ronten” (New license fee system launched in Germany: Background to and issues on the introduction of “broadcasting contribution fee” which is collected from every household”) in Hoso Kenkyu to Chosa (NHK Monthly Report on Broadcast Research), March 2013. (Article in Japanese.)

*Links are for posted items. It is possible that some items are not currently available or are being edited.

Yusuke Sugiuchi

Researcher, NHK Broadcasting Culture Research Institute

Part-time lecturer at Hitotsubashi University

B.A., Faculty of Social Sciences, Hitotsubashi University

M.A. (Sociology), Graduate School of Social Sciences, Hitotsubashi University

Gained credit toward Ph.D. Graduate School of Social Sciences, Hitotsubashi University, before exiting program

Main research themes include broadcasting and media systems in German-speaking countries, and German philosophy and aesthetics relating to Walter Benjamin and Theodor W. Adorno

Return to 26th JAMCO Online International Symposium contents page

Return to 26th JAMCO Online International Symposium contents page